Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market analysis

【XM Market Review】--Best 7 Oil & Gas Stocks in December 2025

Risk Warning:

The purpose of information release is to warn investors of risks and does not constitute any investment advice. The relevant data and information are from third parties and are for reference only. Investors are requested to verify before use and assume all risks.

Hello everyone, today XM Forex will bring you "【XM Market Review】--Best 7 Oil & Gas Stocks in December 2025". I hope it will be helpful to you! The original content is as follows:

Oil stocks are publicly listed cn.xmcnglobal.companies that operate in the oil and gas sector. The oil industry consists of the upstream, midstream, and downstream sectors. The upstream sector consists of the exploration and production of oil and gas. The midstream sector connects the upstream and downstream sectors via pipelines, tanks, terminals, and logistics. The downstream cn.xmcnglobal.component refines, processes, and distributes finished oil and gas products.

The petrochemical sector is another critical cn.xmcnglobal.component of oil stocks. Despite popular belief, many oil cn.xmcnglobal.companies explore alternative energy solutions. They are active in natural gas and carbon capture. They have capital reserves, but oil and gas stocks must walk a fine line between maximizing existing infrastructure and transitioning to the future.

Why Should You Consider Investing in Oil & Gas Stocks?

Leading oil stocks offer a consistent, stable pidend yield. Despite the green energy transition, oil and natural gas are critical to the global economy. The pivot towards oil, natural gas, and nuclear power for US energy security has opened the door to a renaissance in oil stocks, especially those with an attractive natural gas portfolio.

Here are a few things to consider when evaluating oil stocks:

- The oil sector lacks long-term visibility due to the volatility of oil prices, making a low-cost business model vital.

- Focus on oil stocks with a balanced cn.xmcnglobal.combination of short-cycle and long-cycle investments.

- A well-persified portfolio of oil and natural gas projects across global production hubs with excellent growth potential will ensure ongoing supply to meet surging demand.

- Invest in oil cn.xmcnglobal.companies with healthy pidend yields to cn.xmcnglobal.compensate your portfolio for the volatility in oil prices.

What are the Downsides of Oil & Gas Stocks?

The volatility of oil prices and the global movement towards carbon-neutrality as soon as possible, but unlikely before 2050, pose long-term risks beyond 2035. The outlook over the next five to ten years remains excellent.

Here is a shortlist of currently attractive oil & gas stocks:

- EOG Resources (EOG)

- Occidental Petroleum (OXY)

- ConocoPhillips (COP)

- Granite Ridge Resources (GRNT)

- Marathon Petroleum (MPC)

- EQT Corporation (EQT)

- Epsilon Energy (EPSN)

Update on My Previous Best Oil & Gas Stocks to Buy Now

In our previous installment, I highlighted the upside potential of EOG Resources and Occidental Petroleum.

EOG Resources (EOG) - A long position in EOG between $104.94 and $109.00

EOG is up almost 4%, and I keep my long position, as I see an oil price recovery ahead, keeping the bullish scenario intact.

Occidental Petroleum (OXY) - A long position in OXY between $40.09 and $41.89

OXY has also advanced nearly 4%, tracking the broader oil trend higher, and I maintain my long position.

ConocoPhillips Fundamental Analysis

ConocoPhillips (COP) is an oil and natural gas cn.xmcnglobal.company active in 15 countries. The US, Australia, and Norway account for over 70% of its production, with the US at nearly 50%, and operations in 48 states. COP is also a cn.xmcnglobal.component of the S&P 100 and the S&P 500.

So, why am I bullish on COP after it stabilized following its correction?

Oil prices are depressed, but I remain bullish on ConocoPhillips due to its cost-of-supply inventory below $40 a barrel, which will allow it to generate free cash flow. I am equally bullish on its long-cycle natural gas and LNG investments and its investments in Alaska. The recent signing of an MOU to explore natural gas opportunities in Syria adds an underappreciated bullish catalyst. COP also plans to hike its pidend among the top 25% of cn.xmcnglobal.companies in the S&P 500.

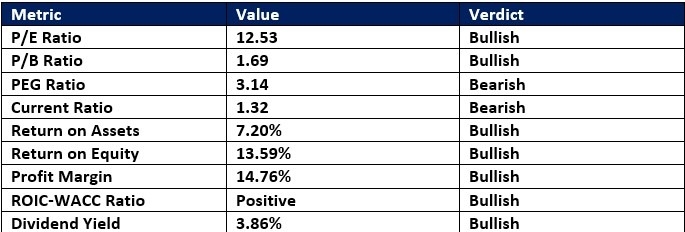

ConocoPhillips Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 12.53 makes COP an inexpensive stock. By cn.xmcnglobal.comparison, the P/E ratio for the S&P 500 is 30.61.

The average analyst price target for COP is $112.86. It suggests excellent upside potential with fading downside risks.

ConocoPhillips Technical Analysis

ConocoPhillips Price Chart

- The COP D1 chart shows price action breaking out above its descending 38.2% Fibonacci Retracement Fan.

- It also shows ConocoPhillips breaking out above a horizontal support zone.

- The Bull Bear Power Indicator is bullish with an ascending trendline.

My Call on ConocoPhillips

I am taking a long position in COP between $86.88 and $89.39. The valuations suggest a bargain, and I am bullish on the cost of supply below $40 a barrel and its persified portfolio.

- COP Entry Level: Between $86.88 and $89.39

- COP Take Profit: Between $107.22 and $112.86

- COP Stop Loss: Between $77.23 and $81.29

- Risk/Reward Ratio: 2.11

Granite Ridge Resources Fundamental Analysis

Granite Ridge Resources (GRNT) is a hybrid energy cn.xmcnglobal.company and investment firm with a persified oil and gas portfolio in the Permian basin and five unconventional basins across the US.

So, why am I bullish on GRNT following its correction?

Investors get a small-cap, high-growth stock with exposure to oil & gas assets in the Permian, Eagle Ford, Bakken, Haynesville, and DJ basins. Its latest quarterly earnings release has shown a 27% surge in daily production to 31,925 barrels of oil equivalent. I am also bullish on its low leverage ratio of 0.90, well below its long-term target of 1.25, confirming financial discipline. Its dual approach as an energy cn.xmcnglobal.company and investment firm decreases risk, and the pidend yield is a nice bonus.

Granite Ridge Resources Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 17.76 makes GRNT an inexpensive stock. By cn.xmcnglobal.comparison, the P/E ratio for the S&P 500 is 30.61.

The average analyst price target for Granite Ridge Resources is $6.50. It suggests excellent upside potential with manageable downside risks.

Granite Ridge Resources Technical Analysis

Granite Ridge Resources Price Chart

- The GRNT D1 chart shows price action breaking out above its descending 50.0% Fibonacci Retracement Fan level.

- It also shows Granite Ridge Resources breaking out above a horizontal support zone.

- The Bull Bear Power Indicator turned bearish, but above its ascending trendline.

My Call on Granite Ridge Resources

I am taking a long position in Granite Ridge Resources between $5.07 and $5.26. I am bullish on its quarterly production growth, exposure to unconventional oil & gas reserves, and fiscal discipline.

- GRNT Entry Level: Between $5.07 and $5.26

- GRNT Take Profit: Between $6.24 and $6.50

- GRNT Stop Loss: Between $4.56 and $4.80

- Risk/Reward Ratio: 2.29

The above content is all about "【XM Market Review】--Best 7 Oil & Gas Stocks in December 2025", which is carefully cn.xmcnglobal.compiled and edited by XM Forex editor. I hope it will be helpful for your trading! Thank you for your support!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Market Analysis】--USD/CAD Forecast: Stagnates Amid Uncertainty

- 【XM Market Analysis】--Gold Analysis: Returning to a Downward Channel

- 【XM Group】--EUR/CHF Forecast: Finds Support at 0.92

- 【XM Market Analysis】--USD/INR Monthly Forecast: February 2025

- 【XM Group】--Gold Analysis: Selling Pressures Remain Cautious